| Committee membership | No. of meetings 2016: 7 | Main committee responsibilities |

| Director | Attendance | - Responsibility for setting the remuneration policy for all executive directors and the Company's Chairman.

- Recommend and monitor the level and structure of remuneration for senior management.

- Review the ongoing appropriateness and relevance of the remuneration policy.

- Appoint remuneration consultants.

- Approve the design of and determine targets for executive directors and other senior executives' performance-related pay schemes.

- Review the design of all share incentive plans for approval by the Board and shareholders. Determine whether awards will be made on an annual basis.

|

| E. Lindqvist | 7 |

| A.M. Thomson | 7 |

| I.B. Duncan | 7 |

| R. Rajagopal (retired 27 May 2016) | 5 |

| P. Larmon (appointed 13 September 2016) | 2 |

Chair's letter

As Chair of the Remuneration Committee ("the Committee") and on behalf of the Board of Directors, I am pleased to present our Board report on remuneration for the 2016 financial year, in line with the requirements of the Large and Medium sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013.

This report comprises two sections. The first part (Section A) describes how the existing policy, approved at the 2016 AGM, was implemented in 2016. The second part (Section B) summarises the policy of the Board with regard to the remuneration of the directors. The full Remuneration Policy, as approved by shareholders at the AGM in 2016, is available on our website.

I would like to thank our shareholders for their support in approving the Remuneration Policy at the AGM in 2016. Our approach is based on simple, competitive reward that closely aligns the pay of our senior executives with our Company's strategy. It is designed to incentivise and motivate the behaviours and actions that will deliver strong returns to shareholders. The new Remuneration Policy was developed to help better achieve these goals, creating a simpler framework aligned with best practice, new corporate governance requirements, and to reflect the changing nature of our business in the coming years.

I would also like to welcome Patrick Larmon, who was appointed on 13 September 2016, to the Board and Committee.

Context and key Committee decisions on remuneration

2016 has seen the business respond to challenging market conditions linked to a subdued demand for industrial machinery and a reduction in oil & gas activity. However, the business has a robust balance sheet with minimal leverage and cash generation has remained strong over the period. This has allowed continued investment in areas where we believe there will be sustainable value creation for shareholders, particularly in Specialist Technologies and focusing on high added value services in Classical Heat Treatment. In 2016, the weakness in trading experienced by the business has been largely offset by the positive currency translation impact resulting from exchange rate movements.

In the context of the above, the decisions made by the Committee in respect of the remuneration of the executives are set out below and reflect the achievement against the relevant performance conditions. The Committee also considers the conditions and pay of the wider workforce when making decisions on remuneration of the executives. All the decisions made by the Committee are in line with the approved Remuneration Policy.

- The annual bonus paid out at 19% of maximum bonus for the Group Chief Executive, and at 14% of maximum bonus for the Group Finance Director, David Landless, due to partial achievement of cash flow targets and personal objectives.

- The 2014 BIP (Bodycote Incentive Plan) did not vest as performance conditions were not met.

- The 2013 CIP (Co-Investment Plan) vested at 93.3% of maximum due to achieving absolute TSR growth of 9.9% during the performance period.

The Committee also reviewed the base salary of the Group Chief Executive and determined that an inflationary salary increase of 3% will be made effective from 1 January 2017. The 2016 average salary increase for the wider UK workforce was 2.1%. As David Landless retired on 1 January 2017, he is not eligible for a salary review or increase. The salary of Dominique Yates, who commenced on 1 November 2016, will be reviewed next in January 2018.

Executive director changes

Dominique Yates joined as Group Finance Director designate and executive director of Bodycote plc on 1 November 2016. Dominique took up his new role as Chief Financial Officer on 2 January 2017, succeeding David Landless who announced his intention to retire from the Board on 25 February 2016 after serving 17 years with Bodycote.

Dominique Yates' remuneration on appointment is in line with the approved Remuneration Policy and full details are set out in Section A of this report. On his appointment, Dominique's base salary was set at £380,000 to reflect his experience and the skills he will bring to the role. Under normal circumstances it would not be envisaged that Dominique will receive higher than normal salary increases in the coming years. From 2017, Dominique is eligible to participate in Bodycote's annual bonus and Bodycote Incentive Plan and has not received any buyout or additional awards.

David Landless' remuneration will be treated in line with the approved Remuneration Policy on his departure. David will not receive any additional payments as a result of his departure. Full details are set out in Section A of this remuneration report.

Finally, I would like to thank my fellow Committee members, as well as all those who supported the Committee in the year, for their support throughout this review. As a Committee we are fully committed to continue an open dialogue with our shareholders. I would welcome your views on the content of this report or any other items you would like to discuss.

E. Lindqvist

Chair of the Remuneration Committee

28 February 2017

Section A: Annual report on remuneration

Auditable section

Total single figure table

| Incumbent | Financial

year | Total

salary/

fees

£000 | Total

pension

£000 | Total

other

benefits1

£000 | Total

fixed

pay

£000 | Annual

bonus

£000 | Total

BIP2

£000 | Total

CIP3

£000 | Total

LTI

£000 | Dividend

equiva-

lent for

BIP+

CIP | Total

variable

pay

£000 | Total

£000 |

|---|

| Executive directors |

| S.C. Harris | 2016 | 511 | 128 | 23 | 662 | 191 | – | 19 | 19 | 3 | 213 | 875 |

| 2015 | 499 | – | 142 | 641 | 130 | – | – | – | – | 130 | 771 |

| D.F. Landless4 | 2016 | 326 | 110 | 23 | 459 | 66 | – | 32 | 32 | 5 | 103 | 562 |

| 2015 | 319 | – | 72 | 391 | 64 | – | 61 | 61 | – | 125 | 516 |

| D. Yates5 | 2016 | 63 | 16 | 2 | 81 | – | – | – | – | – | – | 81 |

| Non-executive directors |

| A.M. Thomson | 2016 | 169 | – | – | 169 | – | – | – | – | – | – | 169 |

| 2015 | 165 | – | – | 165 | – | – | – | – | – | – | 165 |

| R. Rajagopal6 | 2016 | 26 | – | – | 26 | – | – | – | – | – | – | 26 |

| 2015 | 52 | – | – | 52 | – | – | – | – | – | – | 52 |

| E. Lindqvist | 2016 | 62 | – | – | 62 | – | – | – | – | – | – | 62 |

| 2015 | 60 | – | – | 60 | – | – | – | – | – | – | 60 |

| I.B. Duncan7 | 2016 | 67 | – | – | 67 | – | – | – | – | – | – | 67 |

| 2015 | 60 | – | – | 60 | – | – | – | – | – | – | 60 |

| P. Larmon8 | 2016 | 15 | – | – | 15 | – | – | – | – | – | – | 15 |

- Other benefits consist of company car (or allowance), family level private medical insurance and salary supplement. Life assurance cover, sick pay and Board travel expenses are also provided. The only benefit received by the non-executive directors is the payment of Board travel expenses.

- The 2016 figures relate to BIP awards made in 2014 with performance periods ending on 31 December 2016. No shares vested as the targets were not achieved.

- The 2016 figures relate to CIP awards made in 2013 with performance periods ending 30 April 2016. The shares vested in May 2016 at a share price of 599.5p.

- D.F. Landless resigned on 1 January 2017 as Group Finance Director.

- D. Yates was appointed on 1 November 2016 as Group Finance Director designate.

- R. Rajagopal resigned on 27 May 2016 at the AGM.

- I.B. Duncan took over as Senior Independent Director from R. Rajagopal on 27 May 2016.

- P. Larmon was appointed on 13 September 2016 as Non-Executive Director.

Payments to past directors and for loss of office

During the year no payments were made to past directors or for loss of office.

Remuneration for 2016

This section of the report explains how Bodycote's Remuneration Policy has been implemented during the financial year.

Base salary

The base salaries of the executive directors are reviewed on an annual basis. As described in Section B: Directors' Remuneration Policy, a number of factors are taken into account when salaries are reviewed, principally market level salaries payable in FTSE 250 companies and other companies of similar size and complexity, and the individual's role, experience and performance. The 2016 base salary increases and comparative figures can be found in the Remuneration Committee Chair's letter.

Base salaries are reviewed in January every year.

| Name | Position | Salary from 1 January 2016* | Salary from 1 January 2017 |

|---|

| S.C. Harris | Group Chief Executive | £511,309 | £526,650 |

| D.F. Landless (retired on 1 January 2017) | Group Finance Director | £326,556 | n/a |

| D. Yates (appointed 1 November 2016) | Chief Financial Officer | £380,000 | £380,000 |

* The 2016 increase of 2.5% compares to the average 2016 salary increase across the Group of 2.9%.

Fees retained for external non-executive directorships

To broaden the experience of executive directors, the position of non-executive director may be held in other companies, provided that permission is sought in advance. Any external appointment must not conflict with the directors' duties and commitments to Bodycote plc. S.C. Harris has held such a position at Mondi plc since 1 March 2011 and in accordance with Group policy he retained fees for the year of £89,292. D.F. Landless was appointed a non-executive director of Luxfer Holdings plc with effect from 1 March 2013 and retained fees for the year of £58,117. The taxable value of restricted stock units that vested during 2016 was £4,277 and the taxable value of options exercised was £27,396. D.F. Landless has also been appointed as a non-executive director of Innospec Inc. with effect from 1 January 2016 and retained fees for the year of £71,229.

Pension

S.C. Harris and D. Yates are entitled to a salary supplement in lieu of pension at a rate of 25% of basic salary. In addition, a death in service benefit of eight times basic salary is payable.

D.F. Landless no longer participates in the Group's UK contributory defined benefit and defined contribution pension schemes due to him prospectively reaching the lifetime limit. Instead, D.F. Landless receives a salary supplement of 25% of basic salary up to the defined benefit scheme cap and 20% of basic salary above the cap, of which £51,082 was waived during the year. As of 1 April 2016 D.F. Landless received a salary supplement in lieu of pension of £58,456 for the remainder of the year. In addition, a death in service benefit of eight times basic salary was payable.

Taxable benefits

The Group provides other cash benefits and benefits in kind to directors as well as sick pay and life insurance. These include the provision of company car (or allowance) and family level private medical insurance.

| Name | Car/car allowance | Fuel | Healthcare |

|---|

| S.C. Harris | £17,726 | £2,400 | £1,401 |

| D.F. Landless | £19,133 | £1,200 | £1,751 |

| D. Yates (appointed 1 November 2016) | £2,046 | £200 | – |

Long-term savings vehicle

During the financial year the Group made discretionary contributions into the Bodycote Investment Incentive Plan. The plan is entirely cash-based to provide an alternative long-term savings vehicle for senior executives. Group contributions are discretionary, vary year on year and are made in lieu of other elements of pay and therefore are cost neutral to the Group. Any risk in relation to the value of investments made in the plan is borne entirely by participants. The plan was terminated in November 2016 and no further contributions will be made.

Annual performance related bonus

2016 Annual bonus

The Committee has decided, in line with market practice, to disclose information in respect of last year's annual bonus targets. The table below provides the details of the annual bonus awards received in respect of the Group and individual performances in the 2016 financial year.

The annual bonus potential for the period to 31 December 2016 for executive directors was split 77% in respect of Group headline operating profit, 10% on Group headline operating cash flow and 13% on personal strategic objectives. These performance conditions and their respective weightings reflected the Committee's belief that any incentive compensation should be linked both to the overall performance of the Group and to those areas of the business that the relevant individual can directly influence.

Due to significant pressures, particularly in the oil & gas sector, the performance of the Group during the year included headline operating profit of £88.4m at constant exchange rates (13% decrease on prior year) and headline operating cash flow of £79.3m at constant exchange rates (3% decrease on prior year). No bonus is payable on headline operating profit since the threshold was not met.

The Committee also assessed the performance of the Group Chief Executive and Group Finance Director, David Landless, against their personal objectives, which included targets relating to safety, focus on driving growth, implementation of sales strategy, succession planning, as well as implementation of major projects. The Committee concluded that personal strategic objectives were achieved at a level of 80% of the maximum award for the Group Chief Executive. The Group Finance Director, David Landless, achieved 40% of maximum.

| Threshold | Target | | Maximum | % of award | Actual

performance

achieved | CEO | Actual payout

(% of award)

FD |

|---|

| Group headline operating profit | £96.0m | £100.0m | | £105.0m | 70% | £88.4m | 0% | 0% |

| Group headline operating cash flow | £76.6m | £79.8m | | £79.8m | 10% | £79.3m | 8.3% | 8.3% |

| Personal scorecard | | | ✓ | | 20% | | 10.4% | 5.2% |

| Total | | | | | | | 18.7% | 13.5% |

Bodycote Incentive Plan (BIP) and Bodycote Co-Investment Plan (CIP) awards

BIP awards consisting of conditional shares were granted to both executive directors, equivalent in value to 175% of their base salaries on 10 June 2016, and will vest after three years. Details of the awards are set out below. Awards are subject to continued employment and the achievement of the performance conditions specified below.

No awards were made under the CIP scheme.

Directors' interests under the BIP

| Interests as at 1 January 2016 | Awarded in year1 | Vested in year2 | Lapsed in year | At 31 December 2016 | Market price at award date | Market value at date of vesting | Vesting date |

|---|

| S.C. Harris | 366,762 | – | – | 146,776 | – | £5.45 | – | 7 March 2016 |

| – | 151,767 | – | – | 371,753 | £5.77 | – | March 2019 |

| D.F. Landless | 234,241 | – | – | 93,745 | – | £5.45 | – | 7 March 2016 |

| – | 96,927 | – | – | 237,423 | £5.77 | – | March 2019 |

| D. Yates | – | – | – | – | – | – | – | – |

- Mid-market closing price of a share on the day before grant was £6.02. The face value of the award to S.C. Harris was £875,696. The face value of the award to D.F. Landless was £559,269.

- No award vested during the year as performance conditions were not met.

Directors' interests under the CIP

| Interests as at 1 January 2016 | Awarded in year1 | Vested in year2 | Lapsed in year | At 31 December 2016 | Market price at award date | Market value at date of vesting | Vesting date |

|---|

| S.C. Harris | 16,563 | – | 3,174 | 229 | 13,160 | £5.55 | £5.99 | 26 May 2016 |

| D.F. Landless | 20,225 | – | 5,389 | 388 | 14,448 | £5.55 | £5.99 | 26 May 2016 |

- No award was made in 2016.

- Subject to satisfaction of the relevant performance conditions (details of which are set out here). The awards that vested during the year vested at 93.3%.

Bodycote Incentive Plan

Awards with performance periods ending in the year

BIP awards made in 2014 had a three-year performance period ending on 31 December 2016, with 50% of the award subject to satisfaction of a ROCE target and 50% subject to the headline earnings per share (EPS) target. The threshold and maximum targets along with the vesting schedule are set out in the tables below.

| ROCE | | Headline EPS |

|---|

| Performance target | Vesting of element

(% of maximum) | | Performance target | Vesting of element

(% of maximum) |

|---|

| Threshold performance | 18.7% | 0% | | 45.0p | 0% |

| Maximum performance | 23.0% | 100% | | 61.3p | 100% |

| Performance achieved | 17.1% | 0% | | 37.0p | 0% |

If headline EPS at the end of the performance period was below 40.2p, then no awards will vest. Over the period, ROCE was 17.1% and the headline EPS figure for the year was 37.0p. As the targets were not achieved, the Committee concluded that the 2014 share award will not vest.

Awards made in the year

BIP awards with a face value of 175% of salary were granted to both executive directors in June 2016 and will vest in March 2019, subject to the achievement of ROCE and headline EPS growth performance targets. The performance period will end on 31 December 2018. The vesting of these awards will be based on ROCE and headline EPS targets summarised in the table below. The Committee has reviewed the performance targets and these have been altered accordingly to ensure that they remain stretching targets which underpin the Group's objectives.

| ROCE | | Headline EPS |

|---|

| Performance target | Vesting of element

(% of maximum) | | Performance target | Vesting of element

(% of maximum) |

|---|

| Threshold performance | 15.5% | 0% | | 31.7p | 0% |

| Maximum performance | 23.0% | 100% | | 52.0p | 100% |

If headline EPS at the end of the performance period is below 27p, then no awards will vest. The Committee has decided that the ROCE figure of 23% is a good aspiration for the Group and is cognisant of the fact that over-incentivising on capital employed can lead to unintended consequences in terms of short-term capital underinvestment for the business. Dividend equivalents are payable in respect of those shares that vest.

The number and value of shares that were awarded to the executive directors during the year is set out here.

Co-Investment Plan (CIP)

Awards with performance periods ending in the year

As described in Section B: Directors' Remuneration Policy, CIP awards are subject to an absolute TSR target. The CIP awards made in 2013 had a three-year performance period ending on 30 April 2016. The absolute TSR performance targets applicable to this award are set out below.

| Absolute TSR performance target | Vesting level |

|---|

| 4% CAGR + CPI | 50% (0.5:1 match) |

| 10% CAGR + CPI | 100% (1:1 match) |

Over the three-year period, the Group achieved absolute TSR growth of 9.9%. This performance resulted in the TSR targets being achieved at a level of 93.3%. The number and value of shares which vested to each of the executive directors is set out here.

No awards were made in the year.

Implementation of policy in 2017

Base salary is reviewed on an annual basis. The 2017 base salary increases from 1 January 2017 were 3% for the Group Chief Executive and 0% for the Chief Financial Officer, having recently been appointed. As 2016 base salary increases for the Group are applied after the publication of this report, the comparative figure for 2017 can only be provided in next year's report. The comparative figure for 2016 is disclosed in the base salary section.

The new Chief Financial Officer, Dominique Yates, replaced David Landless as of 2 January 2017. His salary on appointment was £380,000. This reflects his significant and valuable experience in international multi-site businesses, and the need to ensure his reward package was appropriate in the context of that in his previous role to facilitate his recruitment. Dominique's company pension contribution is 25% of salary. As of 2017, Dominique was invited to participate in the annual bonus plan at 150% of base salary with deferral of bonus in line with the Remuneration Policy. Dominique will also be invited to participate in the Bodycote Incentive Plan at 175% of salary as of 2017. Benefits provided include the provision of company car (or allowance), private medical insurance, short- and long-term sick pay and death in service cover. Taxable work-related expenses such as travel and relocation are also provided.

David Landless resigned as an executive director as of 1 January 2017. The Remuneration Committee has decided that as a good leaver, David's 2014 and 2015 Bodycote Incentive Plan (BIP) and Co-Investment Plan (CIP) awards will be pro-rated to his leaving date and are subject to achievement of performance conditions at the end of the three-year performance period. The 2016 BIP award will lapse. No CIP awards were made in 2016.

For 2017, the Committee has determined that the annual bonus opportunity for executive directors and senior executives will again be contingent on meeting targets relating to operating profit, cash management and personal objectives. The Committee has reviewed targets for the year to ensure they remain appropriately stretching and relevant for the Group's business strategy. In line with prior years, the 2017 annual bonus targets will be disclosed in the 2017 Annual Report.

The Committee has determined to set the targets for the 2017 BIP awards as disclosed below. The targets below were set in the context of significant pressures in the sector and to ensure that the Committee is able to deliver upper quartile reward for upper quartile performance.

| BIP Targets for 2017 Award |

|---|

| EPS | ROCE |

| Weighting (% of total award) | 50% | 50% |

| Performance period | 3 years | 3 years |

| Threshold performance | 31.7p | 15.5% |

| Vesting level | 0% | 0% |

| Maximum performance | 52.0p | 23% |

| Vesting level | Full vesting | Full vesting |

| EPS underpin | 27.0p | |

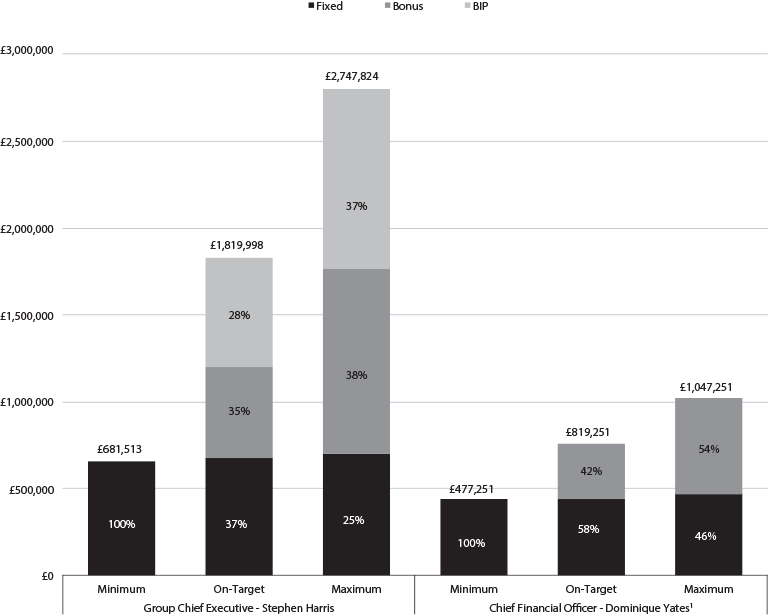

Illustrations of application of Remuneration Policy

The remuneration package for the executive directors is designed to provide an appropriate balance between fixed and variable performance-related components. The Committee is satisfied that the composition and structure of the remuneration package is appropriate, clearly supports the Company's strategic ambitions and does not incentivise inappropriate risk taking. This is reviewed on an annual basis.

The composition and value of each executive director's remuneration package, should they achieve below, at or above target performance, are set out in the charts below.

- For Dominique Yates, the first BIP grant will be in 2017 and therefore no vesting will occur until early 2020.

For the purposes of this analysis, the following methodology has been used:

- Fixed elements comprise base salary and other benefits:

- Base salary reflects the base salary as at 1 January 2017.

- Benefits reflect benefits received in 2016.

- For on-target performance, an assumption of 60% of annual bonus is applied and vesting of 50% of the maximum of the BIP.

- No share price increase or dividend reinvestment has been assumed.

- Fixed elements are salary, benefits and pension.

- Annual variable element is the annual bonus including both cash and deferred shares.

- Long-term variable element is the BIP award and dividend equivalents.

Directors' shareholdings

The interests in ordinary shares of directors and their connected persons as at 31 December 2016, including any interests awarded under the CIP or BIP, are presented below.

As at 25 February 2017, the interests of the directors were unchanged from those at 31 December 2016.

| Beneficial | Shares subject to performance conditions BIP1 | Shares subject to performance conditions CIP1 |

|---|

| Executive Directors | | | |

| S.C. Harris | 177,422 | 371,753 | 13,160 |

| D.F. Landless (retired 1 January 2017) | 10,720 | 237,423 | 14,448 |

| D. Yates (appointed 1 November 2016) | 200,000 | – | – |

| Non-Executive Directors | | | |

| A.M. Thomson | 52,294 | – | – |

| R. Rajagopal2 (retired 27 May 2016) | 22,368 | – | – |

| E. Lindqvist | 12,200 | – | – |

| I.B. Duncan | – | – | – |

| P. Larmon (appointed 13 September 2016) | – | – | – |

- Figures relate to awards not vested under the BIP and CIP schemes.

- Number of shares held on date of retirement.

As described in Section B: Directors' Remuneration Policy, the Board operates a shareholding retention policy under which executive directors and other senior executives are expected, within five years of appointment, to build up a shareholding in the Company. For the purposes of this requirement, only beneficially-owned shares will be counted. At the December 2015 Remuneration Committee meeting it was decided to increase the minimum shareholding requirement to 200% of salary for the Chief Executive and to 150% of salary for the Chief Financial Officer. The new shareholding requirement will not need to be achieved until five years after the adoption of the new requirement. As at 31 December 2016, the Committee is satisfied that executive directors have fulfilled this requirement. At the 31 December 2016 share price, S.C. Harris held 224% of salary and D. Yates will only need to have achieved 150% within five years of his appointment but already holds 340% of salary. D.F. Landless retired on 1 January 2017.

Comparison of overall performance and pay

The chart below shows the values at each financial year end for the last nine financial years of £100 invested in Bodycote plc compared with that of £100 invested in the FTSE All Share Industrial Index. The Committee has chosen this index as the most reasonable comparison in terms of performance.

Historical TSR Performance

Growth in the value of a hypothetical £100 holding over eight years

FTSE All Share industrial comparison based on spot values

The table below shows how total remuneration for the Group Chief Executive, S.C. Harris, developed over the last eight years.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|

| Single figure of remuneration £'000 | 531 | 906 | 3,252 | 3,840 | 3,089 | 1,803 | 771 | 875 |

| Annual variable element award (as a % of maximum) opportunity | 5% | 98% | 95% | 73% | 46% | 73% | 20% | 19% |

| Long-term incentive vesting (as a % of maximum) | 0% | 0% | 100% | 100% | 99% | 44% | 0% | 0% |

Percentage change in remuneration of Group Chief Executive

The total value of salary, non-pension benefits and bonus increased by 12% for the Group Chief Executive in 2016 compared to the previous financial year (2015: £646,132; 2016: £725,739). The equivalent average percentage change for the senior management population as a whole was a 3.1% increase in 2016. The Remuneration Committee has chosen the senior management population as the Group which should provide the most appropriate comparator. The salary increase for the Group Chief Executive in 2016 compared to the previous financial year was 2.5% (2015: £498,838; 2016: £511,309). Non-pension benefits increased by 32% for the Group Chief Executive in 2016 compared to 2015 (2015: £17,596; 2016: £23,200), mainly due to calculation differences in the switch from a company car allowance to a company car. Bonus payable to the Group Chief Executive increased by 47% in 2016 compared to 2015 (2015: £129,698; 2016: £191,230). The equivalent average percentage change in 2016 for the senior management population was 2.4% for salary and a 4.4% increase for bonus.

Relative importance of pay spend

The table below shows the total expenditure in relation to staff and employee costs and distributions to shareholders in 2015 and 2016.

| 2016

£m | 2015

£m | % change |

|---|

| Staff and employee costs | 239.5 | 220.3 | 8.7% |

| Distributions to shareholders | 48.1 | 66.0 | (27.1)% |

Committee membership

During 2016 the Committee was chaired by E. Lindqvist. The Committee also comprised A.M. Thomson, R. Rajagopal (retired 27 May 2016), I.B. Duncan and P. Larmon (appointed 13 September 2016).

The Committee's full terms of reference are available on the Group's website. No Committee members have any personal financial interest (other than as a shareholder), conflict of interest, cross-directorships or day-to-day involvement in the running of the business.

Committee activities

During 2016 the Committee met seven times and once in February 2017 to consider, amongst other matters:

| Theme | Agenda items |

|---|

| Best practice | - The Group's Remuneration Policy, discussions and feedback from the Group's AGM in 2016 and the Corporate Governance Code and Investment Management Association (IMA) guidelines on executive remuneration

- Review of the current UK corporate governance environment and the implications for the Group

|

| Remuneration Policy | - Consideration and approval of the revised Remuneration Policy put to shareholders at the AGM on 27 May 2016 and as summarised in Section B of the Board report on remuneration

|

| Implementation Report | - Consideration and approval of the Implementation Report to be put to shareholders and as summarised in Section B of the Board report on remuneration

|

| Executive directors' and senior executives' remuneration | - Basic salaries payable to each of the executive directors

- The annual bonus and payments for the year ended 31 December 2016

- The annual bonus structure and performance targets for the year ended 31 December 2017

- The vestings made under the Bodycote Incentive Plan (BIP) and Co-Investment Plan (CIP) during the year

- Pension arrangements for senior executives

- Design of a new bonus and share plan as part of benefit package

|

| Reporting | - Consideration and approval of the Board report on remuneration

|

Advisers to the Committee

The Committee was advised by PwC during 2016 on remuneration matters including providing advice on matters under consideration by the Committee, updates on good practice, legislative requirements and market practice. PwC's fees for the year, based on the quantity and complexity of the work undertaken, amounted to £141,900. PwC also undertakes tax and accounting work for the Company. Legal advice was provided by Eversheds and fees amounted to £376. All fees are based on the quantity and complexity of work undertaken. The Remuneration Committee is satisfied that the advice provided on executive remuneration is objective and independent, and that no conflict of interest arises as a result of these services. The Committee reviews the objectivity and independence of the advice it receives from PwC at a private meeting each year. PwC has signed up to the Remuneration Consultant Group's code of conduct.

The Committee also received assistance from the Group Chief Executive and Group Company Secretary, although they do not participate in discussions relating to the setting of their own remuneration. The Committee in particular consulted with the Group Chief Executive and received recommendations from him in respect of his direct reports.

Statement of shareholder voting

The table below displays the voting results on the remuneration resolution as well as the result of the Remuneration Policy at the 2016 AGM:

| 2016 Board report on remuneration

(% votes) | 2016 Directors' Remuneration Policy

(% votes) |

|---|

| Votes cast | 83% | 83% |

| For | 97% | 85% |

| Against | 3% | 15% |

| Number of abstentions | 1,243,471 | 596,122 |

After shareholder consultations and implementation of shareholders' views, the new Remuneration Policy was successfully approved at the 2016 AGM.

E. Lindqvist

Chair of the Remuneration Committee

28 February 2017

Section B: Directors' Remuneration Policy

Remuneration Policy

Bodycote's Executive Remuneration Policy is to attract and motivate our senior executive team to execute our strategy and deliver value to our shareholders while ensuring the Group pays no more than is necessary.

In order to ensure continued alignment between remuneration and the evolving strategic direction of our business, a revised policy was put to our shareholders at the AGM in May 2016 and approved. This policy, applicable from the date of the 2016 AGM, is set out below.

Discretion

The Committee has discretion in several areas of policy as set out in this report. The Committee may also exercise operational and administrative discretions under relevant Plan rules approved by shareholders as set out in those rules. In addition, the Committee has the discretion to amend policy with regard to minor or administrative matters where it would be, in the opinion of the Committee, disproportionate to seek or await shareholder approval.

Executive Remuneration Policy

The table below sets out the key components of executive directors' pay packages, including why they are used and how they are operated in practice.

Current Remuneration Policy table

| Element and how it supports our strategy | Operation of the element | Maximum opportunity under the element | Performance measures |

|---|

Base salary To award competitive salaries to attract and retain the talent required to execute the strategy while ensuring the Group pays no more than is necessary. | Base salaries for executive directors are typically reviewed annually (or more frequently if specific circumstances necessitate this) by the Committee in December each year. Salary levels are set and reviewed taking into account a number of factors including: - Role, experience and performance of the executive.

- The Company's guidelines for salaries for all employees in the Group for the forthcoming year.

- The competitiveness of total remuneration assessed against FTSE 250 companies and other companies of similar size and complexity, as appropriate.

| Whilst the Committee has not set a maximum level of salary, ordinarily, salary increases will not exceed the average increase awarded to other Group employees. Increases may be above this level in certain exceptional circumstances, which may, for example, include: - Increase in scope or responsibility.

- A new executive director who is being moved to market positioning over time.

| None |

Benefits Provides market-competitive benefits at an appropriate cost. | The Company provides a range of cash benefits and benefits in kind to executive directors in line with market practice. These include the provision of a company car (or allowance), private medical insurance, short- and long-term sick pay and death in service cover. This will also extend to the reimbursement of taxable work-related expenses, such as travel and relocation. The provision of other benefits payable to an executive director is reviewed by the Committee on an annual basis to ensure appropriateness in terms of the type and level of benefits provided. The Company provides a long-term savings vehicle into which the executive directors may elect to waive a proportion of pension allowance. In the case of non-UK executives, the Committee may consider providing additional allowances in line with relevant market practice. | The Committee has not set a maximum level of benefit, given that the cost of certain benefits will depend on the individual's particular circumstances. However, benefits will be set at an appropriate level against market practice and needs for specific roles and individual circumstances. | None |

Pension Provides a market-competitive benefit in order to attract the talent required to execute the strategy and provide a market-competitive level of provision for post-retirement income. | The Group operates a defined contribution scheme. Executive directors are provided with a contribution to this scheme or a cash allowance of equivalent value. Base salary is the only pensionable element of remuneration. The same general approach applies to all employees, although contribution levels vary by seniority. | Company contribution (or cash equivalent) of up to 30% of salary. | None |

Annual bonus To incentivise delivery of corporate strategy on an annual basis and reward delivery of superior performance. The deferred portion of the bonus supports longer-term shareholder alignment. | The level of bonus paid each year is determined by the Committee after the year end based on performance against targets. A portion of the annual bonus is paid in cash shortly after the financial year end with the remaining portion deferred for three years in Bodycote shares (see details below). Vesting of the deferred shares is not subject to further performance conditions (please see the 2016 AGM Notice for a summary of the Plan). Dividend equivalents are payable in respect of the shares which vest. From 2018 onwards, 35% of any bonus earned is deferred into shares for three years, conditional on continued employment until vesting date. Transitional treatment applies to deferral for 2016 and 2017. For 2016, any bonus earned over 130% of base salary is deferred into shares. For 2017, 15% of any bonus paid up to a value of 130% of base salary is deferred, with bonus earned over 130% also deferred in full. The deferral above 130% of salary would be capped so that no more than 35% of the total bonus is deferred. Malus provisions apply for the duration of the performance period and to shares held under deferral. Clawback provisions apply to cash amounts paid for three years following payment. Malus and/or clawback may be applied in the following scenarios: - Discovery of a material misstatement resulting in an adjustment in the audited accounts of the Group or any Group Company;

- The assessment of any performance condition or condition was based on error, or inaccurate or misleading information;

- The discovery that any information used to determine the cash payment under the bonus or the number of shares subject to deferral was based on error, or inaccurate or misleading information; or

- Action or conduct of a participant which amounts to fraud or gross misconduct.

The Committee believes that the rules of the Plan provide sufficient powers to enforce malus and clawback where required. | The maximum potential is 200% of base salary for the CEO and 150% of base salary for the CFO and other executive directors.

At the threshold performance level there will normally be no more than 30% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards vesting in full. | The Committee considers the performance conditions selected for the annual bonus to appropriately support the Company's strategic objectives and provide a balance between generating profit and cash to enable the Group to pay a dividend, reward its employees and make future investments; and achieve other strategic goals to drive long-term sustainable return. The weighting of the measures and specific targets are reviewed on an annual basis to ensure alignment with strategy and are set to be in line with budget. Information on measures and weights that will apply for specific years will be included in the relevant year's annual report on remuneration. At least 70% of the bonus will be based on the achievement of Group financial targets. The Committee retains discretion in exceptional circumstances to change performance measures and targets and the weightings attached to performance measures part-way through a performance year if there is a significant and material event which causes the Committee to believe the original measures, weightings and targets are no longer appropriate. Discretion may also be exercised in cases where the Committee believes that the bonus outcome is not a fair and accurate reflection of business performance. The exercise of this discretion may result in a downward or upward movement in the amount of bonus earned resulting from the application of the performance measures. Any adjustments or discretion applied by the Committee will be fully disclosed in the following year's remuneration report. The Committee is of the opinion that given the commercial sensitivity arising in relation to the detailed financial targets used for the annual bonus, disclosing precise targets for the annual bonus plan in advance would not be in shareholders' interests. Actual targets, performance achieved and awards made will be published at the end of the performance periods so shareholders can fully assess the basis for any pay-outs under the annual bonus. |

Bodycote Incentive

Plan (BIP) 2016

To incentivise delivery of long-term strategic goals and shareholder value and aid retention of senior management. | Awards will be granted annually under the Bodycote Incentive Plan (please see the 2016 AGM Notice for a summary of the Plan) subject to a three-year vesting period and stretching performance conditions measured over three years.

Dividend equivalents are payable in respect of the shares which vest. The Committee retains the discretion in exceptional circumstances to adjust the vesting outcome or the targets for awards as long as the adjusted targets are no less stretching. In such an event the Committee will consult with major shareholders and will clearly explain the rationale for the changes in the report on remuneration. Discretion may also be exercised in cases where the Committee believes that the outcome is not a fair and accurate reflection of business performance. The exercise of this discretion may result in a downward or upward movement in the amount of the LTIP vesting resulting from the application of the performance measures. Malus provisions apply for the duration of the performance period. Clawback provisions apply to amounts for two years following vest. Malus and/or clawback may be applied in the following scenarios: - Discovery of a material misstatement resulting in an adjustment in the audited accounts of the Group or any Group Company;

- The assessment of any performance condition or condition was based on error, or inaccurate or misleading information;

- The discovery that any information used to determine the number of shares subject to an award was based on error, or inaccurate or misleading information; or

- Action or conduct of a participant which amounts to fraud or gross misconduct.

The Committee believes that the rules of the Plan provide sufficient powers to enforce malus and clawback where required. | The maximum face value of an award which may be granted under the plan in any year is up to 175% of base salary for the executive directors. At the threshold performance level there will normally be no more than 0% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards vesting in full. | Awards vest based on performance over three years against performance measures chosen by the Committee to align with business and strategic priorities. For the 2016 financial year the measures for executive directors are: In addition, the vesting of awards may only occur if headline EPS is above a defined hurdle level. The Committee considers these performance conditions selected for the BIP to currently appropriately underpin the Company's strategic objectives. Due to the nature of the Company's activities the Committee considers ROCE to provide shareholders with an appropriate measure of how well the Company is performing and is being managed, while EPS provides a measure of the level of value created for shareholders. ROCE and EPS are our top two KPIs as shown in the Bodycote incentive plan of the Annual Report. The Committee may adjust the performance measures attaching to awards and the weighting of these measures if it feels this will create greater alignment with business and strategic priorities. A significant change to the measures used would only be adopted following consultation with major shareholders. The targets for the performance measures are reviewed on an annual basis to ensure alignment to strategy and are set to be in line with budget. Details of performance targets will be included in the relevant year's annual report on remuneration. |

Shareholding requirement To provide alignment of interest between participants and shareholders. | The Board operates a shareholding retention policy under which executive directors are expected, within five years from appointment, to build up a shareholding in the Company. | The CEO and CFO (and other executive directors) are required to build up a holding of 200% and 150% of base salary respectively. | None |

Legacy awards – Co-Investment Plan (CIP) To provide a link between short- and long-term incentive arrangements and to provide further alignment with shareholders. Final award made in 2015. | The CIP provides for the grant of awards of performance-based matching shares to participants on an annual basis in a maximum ratio of 1:1 to the gross investment made in deferred shares. The deferred shares must be held for at least three years. The vesting of matching shares will be based on share price related performance conditions as determined by the Committee.

Dividend equivalents are payable in respect of the matching shares which vest. | Executive directors are invited annually to purchase shares up to 40% of basic salary (net of tax) against which performance based matching shares are granted on a 1:1 basis. | The matching shares are subject to an absolute Total Shareholder Return (TSR) performance measure which is expressed as percentage Compound Annual Growth Rate (CAGR) in excess of CPI: - Threshold performance results in a 0.5:1 match

- Maximum performance results in a 1:1 match.

|

Legacy awards - Bodycote Incentive Plan (BIP) 2006 To incentivise delivery of long-term shareholder value. Aids retention of senior management. Final award made in 2015. | Awards are granted annually under the Bodycote Incentive Plan subject to a three-year vesting period and stretching performance conditions measured over three years. Shares delivered following the vest of an award attract additional dividend shares calculated on the basis of the reinvestment back into shares of the dividend that would have been received had the shares been beneficially held. The Committee retains the discretion in exceptional circumstances to adjust the vesting outcome or the targets for awards as long as the adjusted targets are no less stretching. In such an event the Committee will consult with major shareholders and will clearly explain the rationale for the changes in the report on remuneration. Malus provisions apply for the duration of the performance period and to shares held under deferral. | The maximum face value of an award which may be granted under the plan in any year is up to 175% of base salary for the executive directors. At the threshold performance level there will normally be no more than 0% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards vesting in full. | Awards vest based on performance over three years against performance measures chosen by the Committee to align with business and strategic priorities. For recent grants, the measures for executive directors have been:

In addition, the vesting of awards may only occur if headline EPS is above a defined hurdle level. |

Notes to the Remuneration Policy table

The Committee reserves the right to make any remuneration payments and payments for loss of office, notwithstanding that they are not in line with the policy set out in Section B: Directors' Remuneration Policy where the terms of the payment were agreed (i) before the policy came into effect or (ii) at a time when the relevant individual was not a director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a director of the Company. For these purposes "payments" include the Committee satisfying awards of variable remuneration and, in relation to an award over shares, the terms of the payment being "agreed" at the time the award is granted.

Executive directors' remuneration is reviewed annually and takes into account a number of factors. The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to market but which does not require the Company to pay any more than is necessary. Senior and high performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, which are similar to those offered to the executive directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

Non-Executive Director (NED) fee policy

The policy on Non-Executive Director (NED) and Chairman fees is set out below.

| Element and how it supports our strategy | Operation of the element | Maximum opportunity under the element | Performance measures |

|---|

Fees for non-executive directors

To attract NEDs who have a broad range of experience and skills to oversee the implementation of our strategy. | The fees for the non-executives are determined by the Chairman and the Group Chief Executive. The fee for the Chairman is reviewed by the Board in the absence of the Chairman. The Chairman and non-executive fees are reviewed on an annual basis. When reviewing fees, the primary source of comparative market data is FTSE 250 companies and other companies of similar size and complexity, as appropriate. The fees for the Chairman and non-executives are set at a level that will attract individuals with the necessary experience and ability to make a significant contribution to the Group's affairs. The fees reflect the time commitment and responsibilities of the roles. The Chairman and non-executive directors are not entitled to any pension or other employment benefits or to participate in any incentive scheme. Appropriate benefits may be provided to non-executives and the Chairman from time to time. The Company will pay reasonable expenses incurred by the non-executive directors and Chairman and may settle any tax incurred in relation to these. | Fees for non-executive directors are set out in the statement of implementation of policy in the following financial year section in Section A: Annual report on remuneration. The Company's policy is that the Chairman and non-executive directors receive a fixed fee for their services as members of the Board and its Committees. The fee structure may also include additional fees for chairing a Board Committee and/or further responsibilities (for example, Senior Independent Directorship). In line with the Articles of Association, accumulative total fees for non-executive directors are capped at £500,000 p.a. | None |

Fees retained for external non-executive directorships

To broaden the experience of executive directors, they may hold positions in other companies as non-executive directors provided that permission is sought in advance. Any external appointment must not conflict with the directors' duties and commitments to Bodycote plc.

Statement of consideration of employment conditions elsewhere in the Group

The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to market but which does not require the Company to pay any more than is necessary. Senior and high-performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, similar to the executive directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

The Committee does not consult directly with employees when formulating executive director pay policy. However, it does take into account information provided by the Human Resources function and feedback from employee satisfaction surveys.

In formulating executive director pay policy, the Committee receives information on all employee pay conditions throughout the Group. The Committee does not use any remuneration comparison metrics.

Statement of consideration of shareholders' views

The Committee always welcomes the views of shareholders in respect of pay policy as well as those views expressed on behalf of shareholders by their respective proxy advisers. The Committee documents all remuneration-related comments made at the Company's AGM and feedback received during consultation with shareholders throughout the year. Any feedback received is fully considered by the Committee.

In developing the proposed Remuneration Policy for 2016 and beyond the Remuneration Committee engaged extensively with the Company's key shareholders and their representative bodies. Through this process the Remuneration Committee took on board the feedback received and refined the proposed Remuneration Policy as appropriate to ensure it meets the expectations of our shareholders.

Approach to recruitment remuneration

When recruiting new executive directors, the Company's policy is to pay what is necessary to attract individuals with the skills and experience appropriate to the role to be filled, taking into account remuneration across the Group, including other senior executives, and that offered by other FTSE 250 companies and other companies of similar size and complexity. New executive directors will generally be appointed on remuneration packages with the same structure and pay elements as described in the pay policy table below. Each element of remuneration to be included in the package offered to a new director would be considered separately and collectively in this context.

| Component | Policy |

|---|

| General | The Company's policy is to pay what is necessary to attract individuals with the skills and experience appropriate to the role to be filled. The initial notice period may be longer than the Company's one year policy (up to a maximum of two years). However, this will reduce by one month for every month served, until the Company's policy position is reached. |

| Base salary | Base salary levels will be set at an appropriate level to recruit the best candidate in consideration of the new recruit's existing salary, location, skills and experience and expected contribution to the new role, the current salaries of other executive directors in the Company and current market levels for the role. |

| Other benefits | Other benefits will be considered in light of the provision in place for the other executive director(s). If it is in the best interests of the Company and shareholders, the Committee may consider providing additional benefits, potentially including relocation costs, tax equalisation or advisers' fees. |

| Pension | Pension will be considered in light of the retirement arrangements which are in place for the other executive director(s) with a contribution level considered by the Committee to be appropriate in light of the new recruit's package as a whole, market practice at the time and on a broadly equivalent basis to existing provisions for other executives. |

| Annual bonus | Normal awards will be made under the annual bonus plan in line with the Remuneration Policy. The executive director may be invited to participate in the bonus on a pro rated basis in the first year of appointment. |

| Long-term incentives | Normal awards will be made under the BIP in line with the Remuneration Policy. The executive director may be invited to participate in 'in flight' BIP awards on a pro rated basis when appointed. The Company is required to set out the maximum amount of variable pay which could be paid to a new director in respect of his/her recruitment. In order to provide the Company with sufficient flexibility in a recruitment scenario, the Committee has set this figure as 450% of base salary. This covers the maximum annual bonus and the maximum face value of any long-term incentive awards. This level of variable pay would only be available in exceptional circumstances, and in order to achieve such a level of variable pay, stretching targets would need to be met. For the avoidance of doubt, this 450% variable pay limit excludes the value of any "buyout" payments or awards associated with forfeited awards. |

| Replacement awards | For an external appointment, although there are no plans to offer additional cash and/or share-based payments on recruitment, the Committee reserves the right to do so when it considers this to be in the best interests of the Company and shareholders. Such payments may take into account remuneration relinquished when leaving the former employer and would reflect the nature, time horizons and performance requirements attached to that remuneration. Shareholders will be informed of any such payments at the time of appointment. The Committee may make awards on hiring an external candidate to "buyout" awards which will be forfeited on leaving the previous employer. Our approach to this is to carry out a detailed review of the awards which the individual will lose and calculate the estimated value of them. In doing so, we will consider the vesting period, the option exercise period if applicable, whether the awards are cash or share-based, performance-related or not, the Company's recent performance and payout levels and any other factors we consider appropriate. If a buyout award is to be made, the structure and level will be carefully designed and will generally reflect and replicate the previous awards as accurately as possible. We will make the award subject to appropriate malus and clawback provisions in the event that the individual resigns or is summarily terminated within a certain timeframe. An explanation will be provided at the time of recruitment of why a buyout award has been granted. |

| Internal promotions | For internal promotions any commitments made prior to appointment may continue to be honoured as the executive is transitioned to the new remuneration arrangements. |

Shareholders will be informed of any director appointment and the individual's remuneration arrangements as soon as practicable following the appointment via an announcement to the regulatory news services.

Fee levels for a new Chairman or new non-executive directors will be determined in accordance with the policy set out in Non-Executive Director (NED) fee policy.

Service contracts

All directors' service contracts and letters of appointment are available for inspection at the Company's registered office.

A summary of the key terms of the executive directors' service contracts is set out below.

| S.C. Harris, Group Chief Executive | D.F. Landless, Group Finance Director – retired 1 January 2017 | D. Yates, Group Finance Director designate – appointed Chief Financial Officer

on 2 January 2017 |

|---|

| Date of service contract | 6 October 2008 | 26 September 2001 | 1 November 2016 |

| Notice period | 12 months | 12 months | 12 months |

| Remuneration | - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance

- Entitlement to receive an annual performance-related bonus award

| - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance

- Entitlement to receive an annual performance-related bonus award

- Entitlement to one year's remuneration if employment is terminated on a change of control

| - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance

- Entitlement to receive an annual performance-related bonus award

|

| Termination | Company has right to terminate on payment of a termination payment with agreement of executive | Company has right to terminate on payment of a termination payment | Company has right to terminate on payment of a termination payment |

| Non-competition | During employment and for 12 months thereafter | During employment and for 12 months thereafter | During employment and for 12 months thereafter |

Other than the contents of the contracts, there are no obligations that may give rise to remuneration.

| Director | Date of appointment | Notice period |

|---|

| A.M. Thomson | 1 December 2007 | 6 months |

| P. Larmon | 13 September 2016 | 6 months |

| R. Rajagopal (retired 27 May 2016) | 24 September 2008 | 6 months |

| E. Lindqvist | 1 June 2012 | 6 months |

| I.B. Duncan | 17 November 2014 | 6 months |

The non-executive directors of the Company (including the Chairman) do not have service contracts. The non-executive directors are appointed by letters of appointment. Each independent non-executive director's term of office runs for a maximum three year period.

The initial terms of the non-executive directors' positions are subject to their re-election by the Company's shareholders at the next AGM and to re-election at any subsequent AGM at which the non-executive directors stand for re-election.

All directors will be put forward for re-election by shareholders on an annual basis.

Termination remuneration policy

It is the Company's policy that executive directors have service contracts with a one-year notice period and terminable by one year's notice by the employer at any time, and by payment of one year's basic salary and other fixed benefits in lieu of notice by the employer. All future appointments to the Board will comply with this requirement.

The Committee will honour executive directors' contractual entitlements. Service contracts do not contain liquidated damages clauses. If a contract is to be terminated, the Committee will determine such mitigation as it considers fair and reasonable in each case. There are no contractual arrangements that would guarantee a pension with limited or no abatement on severance or early retirement. There is no agreement between the Company and its executive directors or employees, providing for compensation for loss of office or employment that occurs because of a takeover bid (other than a legacy arrangement for D.F. Landless).

| Component | Policy |

|---|

| Compensation for loss of office in service contracts | Currently, under the terms of the executive directors' contracts, the Company may at its choice, in lieu of giving notice, terminate an executive director's service contract by making a payment equivalent to: - one year annual base salary, 25% of base salary in respect of all other remuneration and benefits (other than annual bonus and incentives) and annual bonus equal to the average bonus paid up to three years prior to the date of notice.

|

| Treatment of cash element of the bonus under Plan rules | If termination is by way of death, injury, illness, disability, redundancy, retirement or any other circumstances the Committee determines (a "good leaver"), the level of bonus will be measured at the bonus measurement date. Bonus will normally be pro-rated for the period worked during the financial year. The Committee retains the discretion: - to determine that an executive is a good leaver. It is the Committee's intention to only use this discretion in circumstances where there is an appropriate business case which will be explained in full to shareholders;

- not to pro-rate the bonus to time. The Committee's policy is that it will pro-rate bonus for time. It is the Committee's intention to use its discretion to not pro-rate in circumstances where there is an appropriate business case which will be explained in full to shareholders.

Under all other circumstances no bonus will be earned on cessation of employment (other than set out above in the legacy arrangements for current executive directors). |

| Treatment of unvested deferred bonus awards under Plan rules | If termination is by way of death, injury, illness, disability, redundancy, retirement or any other circumstances the Committee determines (a "good leaver"), deferred shares may be released to the participant at the normal vesting date.

Under all other circumstances unvested awards will lapse on cessation of employment. The Committee has the following elements of discretion: - to determine that an executive is a good leaver. It is the Committee's intention to only use this discretion in circumstances where there is an appropriate business case which will be explained in full to shareholders;

- to vest deferred shares at the end of the original deferral period or at the date of cessation. The Committee's policy is that shares will vest on the original date of vesting. The Committee will make this determination depending on the type of good leaver reason resulting in the cessation.

|

| Treatment of unvested BIP 2016, BIP 2006 and CIP awards | On cessation of employment, awards under the BIP and CIP will lapse in full, unless the Committee determines that the individual is a good leaver (see above for definition). In instances where the Committee determines that awards should not lapse in full, awards will normally vest at the normal vesting date, pro-rated for time served and subject to the achievement of the original performance conditions. The Committee has the following elements of discretion: - to determine that an executive is a good leaver. It is the Committee's intention to only use this discretion in circumstances where there is an appropriate business case which will be explained in full to shareholders;

- to measure performance over the original performance period or at the date of cessation. The Committee will make this determination depending on the type of good leaver reason resulting in the cessation; and

- to pro-rate the maximum number of shares to the time from the date of grant to the date of cessation. The Committee's policy is that it will pro-rate awards for time. It is the Committee's intention to use discretion to not pro-rate in circumstances where there is an appropriate business case which will be explained in full to shareholders.

|

| Exercise of discretion | In the event that an executive director leaves the Company, the Committee's policy for exit payments is to consider the reasons for cessation and consequently whether any exit payments other than those contractually required are warranted. Further, in the event of a compromise or settlement agreement, the Committee may agree payments it considers reasonable in settlement of legal claims. This may include an entitlement to compensation in respect of their statutory rights under employment protection legislation in the UK or in other jurisdictions. The Committee may also include in such payments reasonable reimbursement of professional fees in connection with such agreements. |

| Change of control | Our policy is not to have a change in control clause in executive directors' service contracts. S.C. Harris does not have a change of control clause. D.F. Landless' service contract was agreed in accordance with what was considered best practice at the time of its execution in 2001 and provides for one year's remuneration if his employment had been terminated on a change of control. This provision has been preserved. To the extent that executive contracts are renewed, or new appointments made, the Committee will continue to adopt a policy of not having change of control clauses in service contracts. In any case, legally appropriate factors would be taken into account to mitigate any compensation payment, covering basic salary, annual incentives and benefits, which may arise on the termination of employment of any executive director, other than payments made on a change in control or for payments in lieu of notice. On change of control the awards under the Company's incentive plans will generally vest subject to performance and time apportionment as determined by the Committee and in accordance with the rules of the relevant Plan. |