Smooth

sailing

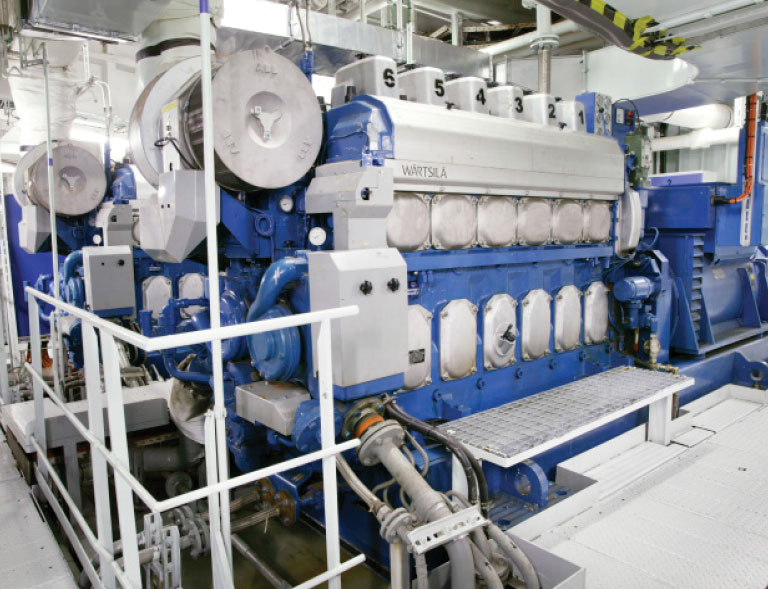

Diesel engine pistons

During the diesel engine cycle, combustion gases push the pistons downward generating power on the working stroke. Heat treatment gives the finished piston and its pin the ability to withstand high temperatures and extended runs, delivering high performance over sustained periods. Depending on the specific piston component, they undergo casehardening, induction hardening, tempering, stress relieving and nitriding.

For further information about our services go to

www.bodycote.com/services

Courtesy of Wärtsilä Corporation

Courtesy of Koncentra Pistons

Whilst the Automotive & General Industrial (AGI) marketplace has many multinational customers, which tend to operate on a regionally-focused basis, it also has numerous medium-sized and smaller businesses, all of whom are very important to Bodycote. Generally, there are more competitors to Bodycote in AGI and much of the business is locally oriented, meaning that proximity to the customer is very important. Bodycote's extensive network of 126 AGI facilities enables the business to offer the widest range of technical capability and security of supply, while continuing to increase the proportion of technically differentiated services that it offers. Bodycote has a long and successful history of serving this wide-ranging customer base.

Results

AGI business revenues were £349.7m in 2016, compared to £323.7m in 2015, an increase of 8.0% (3.2% decrease at constant exchange rates).

AGI revenues saw a small benefit from the acquisitions made towards the end of the year. However, this was more than offset by the impact of plant closures from 2015. As a result, like-for-like AGI sales were down a modest 1.8% for the full year, with the second half revenues virtually flat against the same period in 2015. Weakness in the General Industrial business was more pronounced in North America than in Western Europe, but emerging markets registered good growth. While some OEM destocking held our business back in North America, car and light truck revenues were strong in Western Europe, with solid growth in the key French and German markets, as we won business building on the strengths of our Specialist Technologies. Strong car and light truck revenue growth was recorded in emerging markets, as the Group benefited from its investments in these markets. The depressed bus and heavy trucks market negatively impacted sales in the USA and Sweden.

Headline operating profit1 in AGI was £58.5m compared to £53.4m in 2015. Headline operating margin increased to 16.7% (2015: 16.5%), reflecting a further improvement in mix towards higher-value work, along with strong cost control. Revenues from the Group's Specialist Technologies grew well at high margins.

Net capital expenditure in 2016 was £37.4m (2015: £39.8m), which represents 1.1 times depreciation (2015: 1.3 times). This included further investments in China, Mexico, Czech Republic and Turkey. The Group also completed the acquisition of five plants for total consideration of £30.2m as part of its bolt-on acquisition strategy, adding sites in Germany, the USA and Canada.

Return on capital employed in 2016 decreased to 15.2% (2015: 16.0%), reflecting the lower profitability as a result of lower sales. It is worth noting that the acquisitions have impacted the average opening and closing capital employed figures significantly more than they have contributed in terms of profitability, given that they all completed towards the end of the year. Excluding acquisitions, return on capital employed would have been 15.5%.

Achievements in 2016

AGI has clearly had to contend with weak General Industrial demand across all of its territories. Nonetheless, the continued development of our emerging markets businesses in China, Mexico, Czech Republic and Poland has been pleasing. We continue to win good high-margin business, and our AGI focused Specialist Technologies of S3P, Low Pressure Carburising and Corr-I-Dur® all continue to be a key driver of the improved profitability in the AGI business.

Organisation and people

At 31 December 2016, the number of full-time equivalent employees in AGI was 3,502 (including 188 from acquired businesses) compared to 3,331 at the end of 2015 and its peak of 5,244 in July 2008.

Looking ahead

The decline in the General Industrial business has undoubtedly been largely driven by the knock-on impact on capital equipment demand from lower activity in the oil & gas and other resources sectors. We do not foresee further significant declines in these markets. As far as the Automotive business is concerned, any policy changes by the new USA administration towards the existing USA fuel efficiency targets (and on international trade agreements more generally) could have an impact on our business but the likely outcome is unpredictable at this stage.

The multinational nature of Bodycote's AGI businesses puts us in a great position to take advantage of market developments. In the meantime, we will continue to build on the success of enhancing margins through capturing high-value work. The focus on improving customer service helps drive this effort while the prioritisation of existing capacity in favour of higher-value work and investing in Specialist Technologies provides additional momentum. In addition the Group will continue with its strategy of adding to its existing footprint in the rapid-growth countries when the right opportunities at the right price present.

- Headline operating profit is reconciled to operating profit in note 2 to the financial statements. Bodycote plants do not exclusively supply services to customers of a given market sector (see note 2 to the financial statements).

AGI revenue by geography

£m

- Western Europe 214.9

- North America 94.3

- Emerging markets 40.5

- Total 349.7

AGI revenue by market sector

£m

- Aerospace and Defence 9.4

- Energy 8.3

- Automotive 162.5

- General Industrial 169.5

- Total 349.7